What is the average cost of motorcycle insurance? – The regular cost of motorcycle insurance in the United States is €729 per year. However, prices can vary by more than 150 percent, depending on where you live. However, regardless of state law, all passengers benefit from current coverage. We collected thousands of estimates from across the country to determine how much it costs to cover your bike, health, and finances.

We looked at motorcycle insurance quotes from all 50 states and found that the average cost of motorcycle insurance in the United States is $729 for a full year of coverage. Because the cost of coverage varies depending on where you live, it’s a good idea to shop around for lots of quotes to discover the best deal.

The following are the coverage limits:

- Bodily injury liability cover: €100,000 per person/€300,000 per accident

- Property Damage Liability Coverage: €50,000

- Comprehensive and collision deductible: €500

States with high and cheap motorcycle insurance

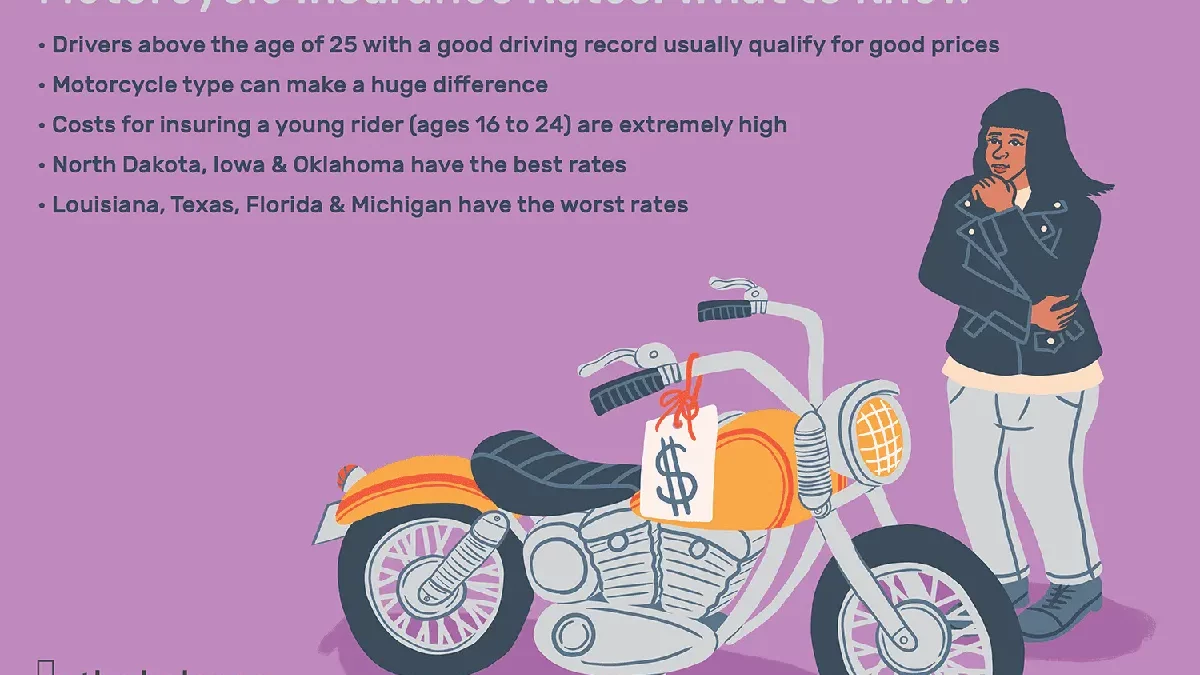

The five states with the inexpensive insurance quotes had rates at least 36% cheaper than the national average. All the states with the lowest rates were in the Midwest and Great Plans. The following are the states with affordable rates:

- North Dakota

- Iowa

- Wyoming

- South Dakota

- Nebraska

Unlike the most affordable states, the most expensive states for motorcycle insurance did not reveal a significant geographic correlation. However, they have larger populations and longer driving seasons. The following are the states with the most motorcycle insurance:

- California

- Louisiana

- Missouri

- Michigan

- Florida

Paying for motorcycle insurance in 12 monthly installments is often more expensive than paying for a one-year policy in a lump sum. Pay-in-full discounts are popular with major insurers. If you live in a state where attention is expensive or want a lower overall rate, consider purchasing six to twelve months of motorcycle insurance coverage at one time instead of monthly.

Motorcycle insurance rates based on age

Insurance companies often charge higher premiums for younger drivers because they are more likely to be involved in accidents. These insurance companies assess the cost of your coverage based on your age and years of driving experience, the city you live in, the number of policies you select, and your driving record.

Motorcycle insurance rates depend on the type of motorcycle

Insurance companies base their price on all available safety and risk information. Therefore, the type of motorcycle you ride significantly impacts your premium.

In particular, insurers consider the following factors:

- Value of your motorcycle: Because more expensive motorcycles are more expensive to repair and replace, insurance companies charge you more to cover them if you purchase comprehensive and collision insurance.

- Safe nature of your bike: Bikes with increased safety features, such as anti-lock brakes, are less likely to be involved in an accident and, as a result, are often less expensive to insure than bikes without those features.

- Accident rate: Certain types and styles of motorcycles are more likely to be involved in an accident than others.

- Theft Rate: Insurance companies typically charge a higher premium to cover a frequently stolen type of bike. This is because there is a higher chance that insurance will have to pay a comprehensive claim. As a result, flashy, expensive bikes that are prime targets for theft are more expensive to insure.

Bottom line:

Motorcycle insurance, like car insurance, protects you financially if you cause an accident. Comprehensive coverage insurance can also include comprehensive and collision coverage, compensating for damage to your bike caused by an accident or other reasons, such as theft. Some motorcycle insurance companies include extra roadside assistance and trip cancellation coverage. The amount of coverage needed varies by state, with some states requiring personal injury protection while others do not. Only a few states allow residents to legally ride motorcycles without insurance or proof of financial responsibility. However, we recommend that you protect yourself with insurance coverage.

Nationwide offers the lowest average prices, while Markel is a good choice for collectors because it covers more motorcycles than many other insurers.

You can combine your auto and motorcycle insurance policies. Most insurers provide a 5% to 10% multi-policy discount for combining your auto.

Check out our blogs for information on how to find top-rated airport parking, the best parking spots in your city, the most affordable insurance for your car, and affordable car washes near you.

Terms Related to Motorcycle Insurance

average [motorcycle insurance]

average [motorcycle insurance] cost

typical [motorcycle insurance] cost

average price of [motorcycle insurance]

average price for [motorcycle insurance]

what is the average cost of [motorcycle insurance]

cost for [[motorcycle insurance]

average insurance cost for motorcycle

average cost for [motorcycle insurance]

insurance on a motorcycle] cost